This is one of our favorite quotes from Warren Buffett.

Many consider Buffett the greatest investor of all time. "Risk comes from not knowing what you are doing."

It's a good time to check asset allocation.

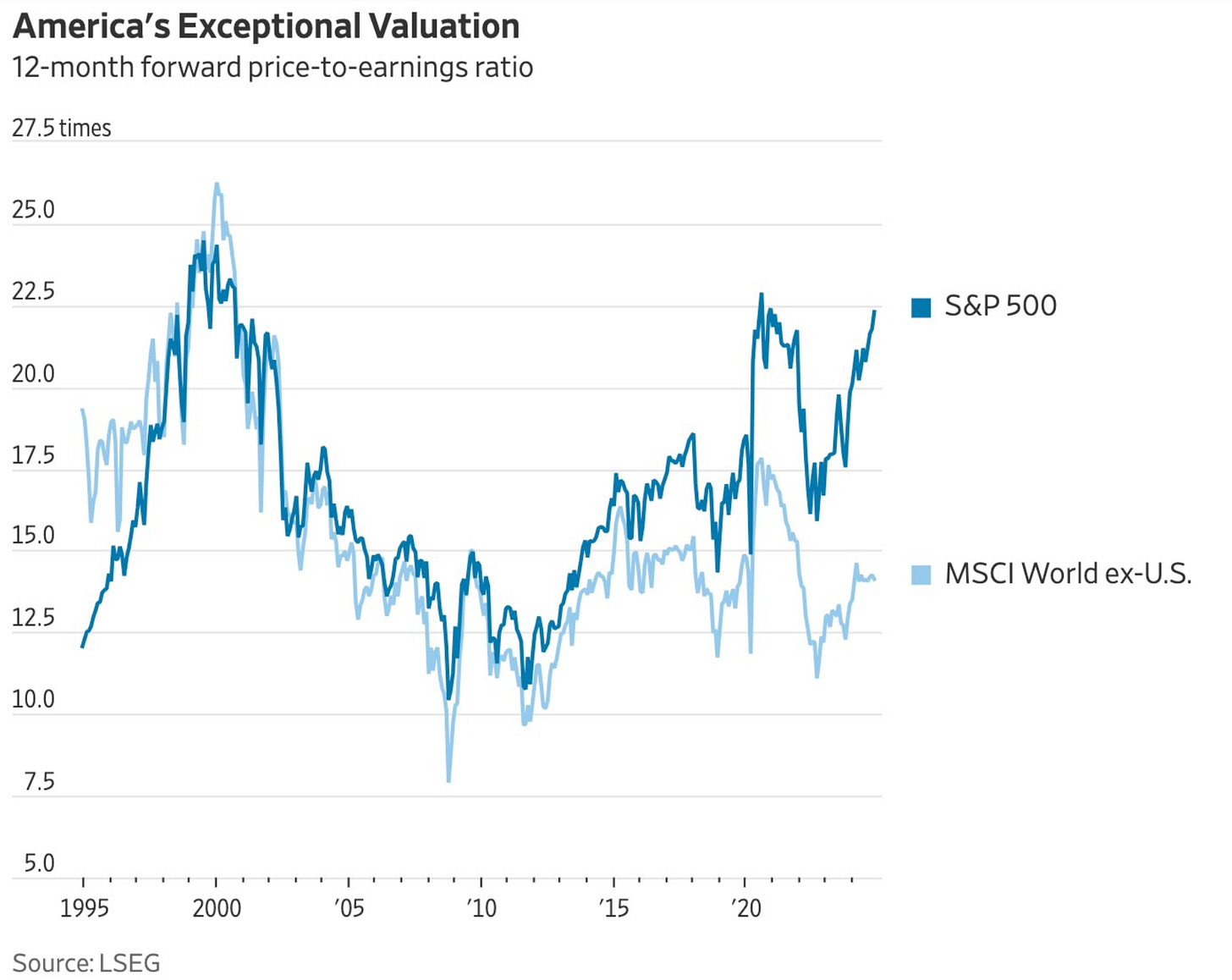

The US Large Capitalization (Large Cap) stocks, led by the Magnificent Seven, have had a great last two years. Here are two interesting charts showing that stock valuations are at historical highs. The first compares the price-earnings ratio (PE) of the S&P 500 to the PE ratio of the rest of the world. The U.S. has had consistently higher valuations for many years, but recently, the gap has grown significantly.

The second chart shows the Buffett indicator, a calculation that Buffett follows. This indicator compares the value of all U.S. Corporate equities to the size of the economy as measured by Gross Domestic Product (GDP). The Buffett indicator is well above the trend line and close to an all-time high.

In summary, U.S. large-cap stocks are costly - whether measured against stock prices worldwide (i.e., their average PE) or relative to GDP.

This does not necessarily represent a short-term sell signal, as unusual trends can continue for an extended period, and US earnings growth has been strong. However, it does indicate that longer-term relative valuations of U.S. Large Cap stocks are likely to stagnate or return to previous ranges of relative value. Therefore, for long-term investors and goals, it's a good time to consider your asset allocation and diversification.

Changes to 401(k) s are coming in 2025.

As part of Secure Act 2.0, which was enacted in 2022, a significant change will be effective starting in 2025. Workers aged 60 to 63 can make a “super” catch-up contribution of $10k or 150% of the standard catch-up contribution, which applies to workers 50 and over, whichever is greater. This is in addition to the base contribution of $23,000 (2025) for all workers. Another change that forced higher-paid workers to take their company match as past tax Roth, as opposed to pre-tax, has been delayed until 2026. All of the 2025 tax-related limits can be found on our website here.

I Bonds and one fewer way to purchase them.

I Bonds and Treasury Inflation-Protected Securities (TIPS) are the two ways to buy inflation-protected securities backed by the U.S. Government. We wrote about TIPS in a previous newsletter. For some people, I Bonds have a significant advantage over TIPS. Interest on I Bonds is not recognized until they mature in 30 years or are redeemed. TIPS interest is paid and recognized twice yearly, and the interest and inflation adjustment are federally taxable. I Bonds can only be purchased on TreasuryDirect.gov, and the limit is $10k/person/year. Before 2025, an additional purchase of I Bonds of up to $5k could be made with your tax refund. Unfortunately, the Treasury has discontinued that backdoor method of increasing the amount of I Bonds one may purchase.

Smarter Bear is always available for a free consultation to answer questions and discuss whether our services can help address your needs. You can reach us at smarterbear.net. We offer no-cost second opinions for DIYers or people working with another investment or financial advisor.

We write our own newsletter, so we know these topics well. Many advisors and firms employ marketing departments, generative AI, or third-party content services to produce their newsletters.

If you know others who would like to be added to our list, feel free to add them at https://smarterbear.substack.com. We aim to write short, helpful, and easy-to-read items on financial topics of interest. We'd like to hear any suggestions for topics to cover in future newsletters.

None of the above is intended as a substitute for investment, tax, or legal advice. Your personal situation will determine what's best for you, and we recommend you consult an appropriate professional advisor.