Health Savings Accounts (HSAs) are valuable

HSAs, which must be paired with high-deductible health care plans, have a triple tax advantage:

pre-tax contributions

tax-free growth

tax-free withdrawal for qualified expenses.

Funds can be used for most qualified medical expenses, including medical/dental/vision care, health care premiums, Medicare, Medicare Advantage, and Part D Drug plans. The exception is Medigap plans—the premiums are not qualified expenses for HSAs.

Unlike Flexible Savings Accounts (FSAs) for health care and dependent care, HSAs do not need to be spent in a single year and can accumulate and grow over time.

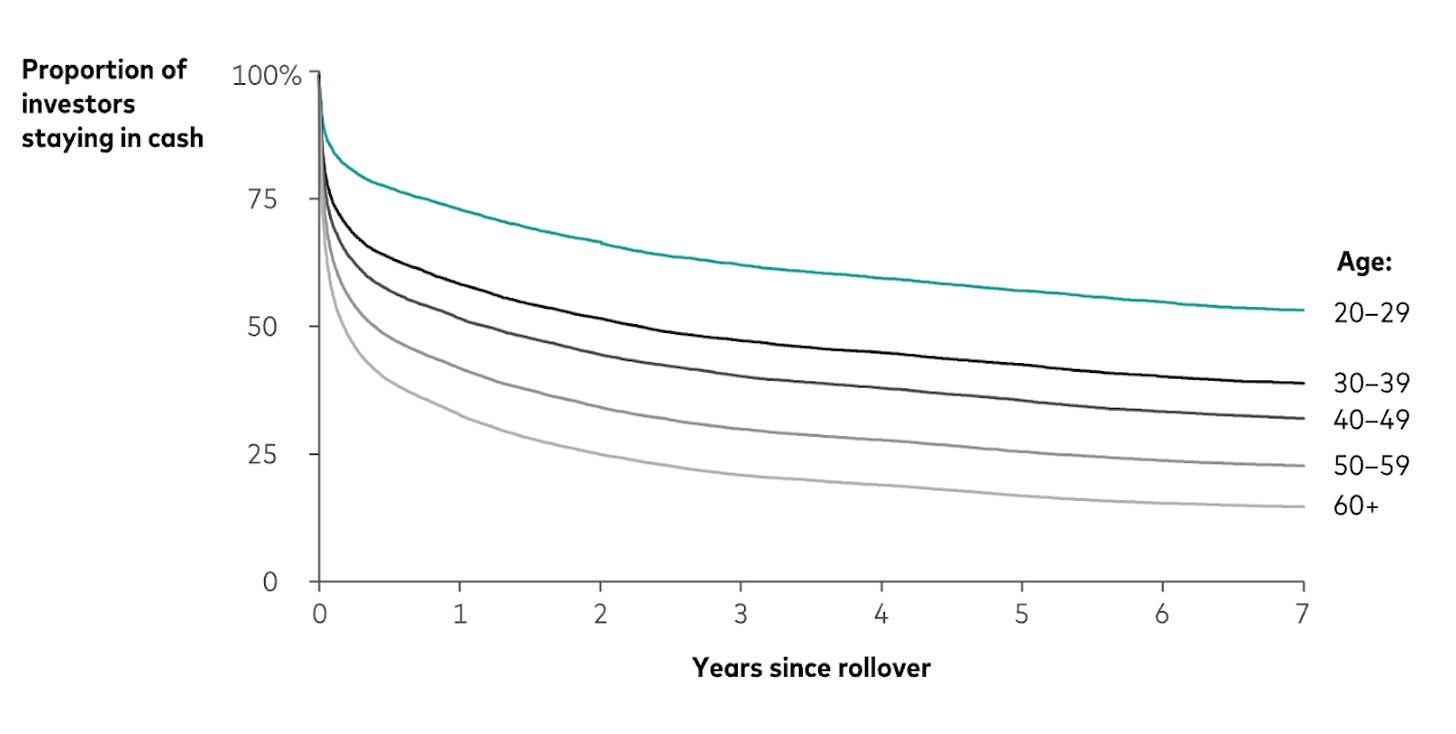

"Cash drag" in IRA rollovers:

When investors roll over a 401k to an IRA, the investments they had in the 401k are often sold, and the IRA receives cash. Many investors fail to deploy that cash back into stock and bond investments consistent with their asset allocation plan, which can greatly reduce the size of their retirement accounts over time. Thanks to Vanguard for their research on IRA rollovers for 2015 through 2022 and this chart.

What is a Business Development Company (BDC)?

Smarter Bear has been asked several questions about BDCs recently. Some investment advisors and investment salespeople are heavily promoting them.

BDCs offer access to private debt and private equity pools in an instrument that can be publicly traded, privately traded, or non-traded. BDCs are rapidly gaining in popularity. BDCs are often noncorrelated to stocks and most types of bonds, which is helpful when building a diversified portfolio. Some BDCs can offer attractive annual dividend payouts. BDCs are highly leveraged, lightly regulated, highly volatile, offer investment advisors very high commissions, and charge annual expense ratios exceeding 10%. In addition, the way in which the BDC is traded (publically, non-traded, or privately traded) may limit liquidity.

Finally, BDC dividends are usually taxed as ordinary income, less favorable than other income-oriented investments such as municipal or treasury bonds, dividend-paying stocks, or REITs. Smarter Bear recommends getting advice from someone without a financial interest in the transaction before you decide to invest.

Smarter Bear is always available for a free consultation to answer questions and discuss whether our services can help address your needs. You can reach us at smarterbear.net. We offer no-cost second opinions for DIYers or people working with another investment or financial advisor.

We write our own newsletter, so we know these topics well. Many advisors and firms employ marketing departments, generative AI, or third-party content services to produce their newsletters.

If you know others who would like to be added to our list, feel free to add them at https://smarterbear.substack.com. We aim to write short, helpful, and easy-to-read items on financial topics of interest. We'd like to hear any suggestions for topics to cover in future newsletters.

None of the above is intended as a substitute for investment, tax, or legal advice. Your personal situation will determine what's best for you, and we recommend you consult an appropriate professional advisor.